Key Takeaways

Insurance costs are always a paramount concern for fleet managers and owners. As businesses grapple with thinning margins and escalating overheads, finding innovative ways to control these costs can make a tangible difference to the bottom line. With the power to transform data into actionable insights, telematics offers a solution to monitor and influence insurance premiums. Here's what you need to know about fleet insurance, telematics, and the relationship between the two.

Table of Contents

- Understanding Insurance Premiums: The Role of Risk

- Insights from Telematics: The Path to Reduced Risk

- Three Key Ways Telematics Can Reduce Premiums

- Improving Premiums for Your Fleet

Understanding Insurance Premiums: The Role of Risk

Since the inception of the insurance industry, the heart of the premium calculation has always been risk. The lower the risk associated with an asset, the lower the premium, and vice versa. For fleet owners, this translates to a need to improve their risk profile, which can directly impact their claims history and reduce insurance costs.

Telematics for insurance utilises advanced technology to monitor vehicle and driver behaviour, which helps assess the associated risk more accurately. Since fleet insurance premiums are primarily based on this perceived risk, having clear and concrete data on fleet operations becomes invaluable.

Insights from Telematics: The Path to Reduced Risk

With the vast data provided by telematics, fleet managers obtain insights into driver behaviours such as speeding, sudden braking, and sharp turns. Such behaviours, when recurrent, indicate higher risk, increase the likelihood of insurance claims, resulting in higher premiums. With actionable data, managers can not only detect these patterns but can take proactive steps to correct them, ensuring safety and potentially reducing insurance costs.

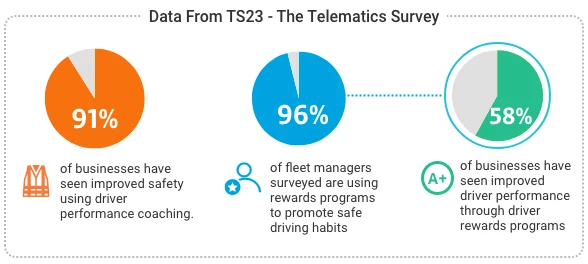

One of the most impactful features of telematics systems like TN360 is driver scorecards. These scorecards offer a detailed view of each driver's on-road performance, allowing managers to address risky behaviours through tailored training programs. These systems can also power safety and rewards programs, enabling fleet managers to create a safer and more positive culture. Insurance companies recognise this proactive approach and are often more inclined to offer competitive premiums to fleets that employ such systems.

Three Key Ways Telematics Can Reduce Premiums

Integrating telematics in fleet management has revolutionised how businesses approach safety, security, and cost management. By harnessing real-time data, telematics plays a pivotal role in shaping insurance premiums, offering companies tangible ways to minimise risk. Here are three crucial ways telematics can help businesses reduce insurance costs.

Promoting Safer Driving

Telematics systems provide a unique opportunity to monitor and improve driver behaviour, making roads safer for everyone. With real-time data, fleet managers can identify patterns or habits that might lead to accidents, such as frequent hard braking or rapid acceleration. Addressing these issues through targeted training or incentives can significantly reduce the likelihood of costly incidents.

Additionally, the real-time feedback provided by telematics can serve as a prompt for drivers, nudging them towards safer habits on the road. Over time, this continuous feedback loop engrains better driving practices and fosters a safety-first culture within the fleet. As a result, companies often see a decrease in accident-related costs and reductions in insurance premiums as their claims history improves.

Guarding Against Theft and Improper Use

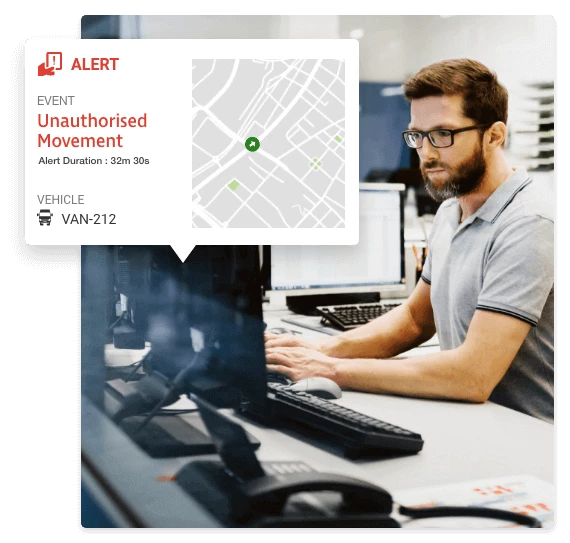

A fleet's security extends beyond just safe driving practices. Theft or unauthorised use of vehicles can lead to significant financial setbacks and increased premiums. With telematics, fleet managers can set up geofences, sending alerts if a vehicle moves outside a designated area or operates outside of approved hours. This proactive approach to security can deter potential theft and quickly alert managers to any unauthorised activities. Vehicle monitoring can also act as a deterrent for potential thieves, further reducing the time and hassle of dealing with unauthorised vehicle use.

As fleet security tightens through telematics, insurance companies often recognise the reduced risk of theft or unauthorised usage. These improved policies can translate to more favourable insurance terms and premiums.

Protecting Against Fraudulent Claims

Unfortunately, road incidents are often a part of fleet operations. When they occur, telematics systems can provide invaluable concrete evidence for what happened. Telematics systems can capture comprehensive data before, during, and after an incident, offering a clear picture of the circumstances leading up to it. This data can help determine liability, potentially saving companies from unjust claims.

Many telematics solutions also integrate with dashboard cameras, adding a visual layer of evidence. This combination of data and video ensures fleet operators are well-equipped to handle claims, offering objective proof when disputes arise. In the eyes of insurance providers, this capability can translate to a reduced risk of high payouts, further helping to bring down insurance costs.

That video data is objective and following an accident, it can serve as reliable evidence in a dispute regarding which party was at fault. This makes it valuable in protecting fleets against expensive legal action – both in proving that negligence was not involved and in expediting a rapid settlement instead of prolonged, costly litigation.

Improving Premiums for Your Fleet

TN360 by Teletrac Navman is an AI-powered platform that transforms raw data into actionable insights, offering fleet managers a 360-degree view of their operations. From enhancing safety to managing risk TN360 has the tools that you need to battle rising insurance premiums. Contact us to learn how TN360 can transform how you manage your fleet or build a custom solution using our online tool to see how the application can meet your needs.