One of the many advantages of having vehicle trackers installed is that it can help to reduce insurance premiums for fleets. There are several areas where telematics can be particularly important in cutting fleet insurance costs, including risk management, driver safety and theft.

The presence of telematics technology indicates straight away to an insurer that the fleet in question is taking active steps to manage and reduce risk. They are quite likely to look favourably on this. Likewise, vehicle tracking technology provides valuable, in-depth information on driver and vehicle performance, which can in turn be used to shape driver training programmes – addressing shortcomings where necessary – and thus have a positive impact on reducing premiums. Also, in the event that a vehicle is stolen, having a vehicle tracker allows fleets to keep track of its location, which could prove useful in either tracking the vehicle down or identifying the perpetrator.

Q: What should fleets be doing to manage risk effectively?

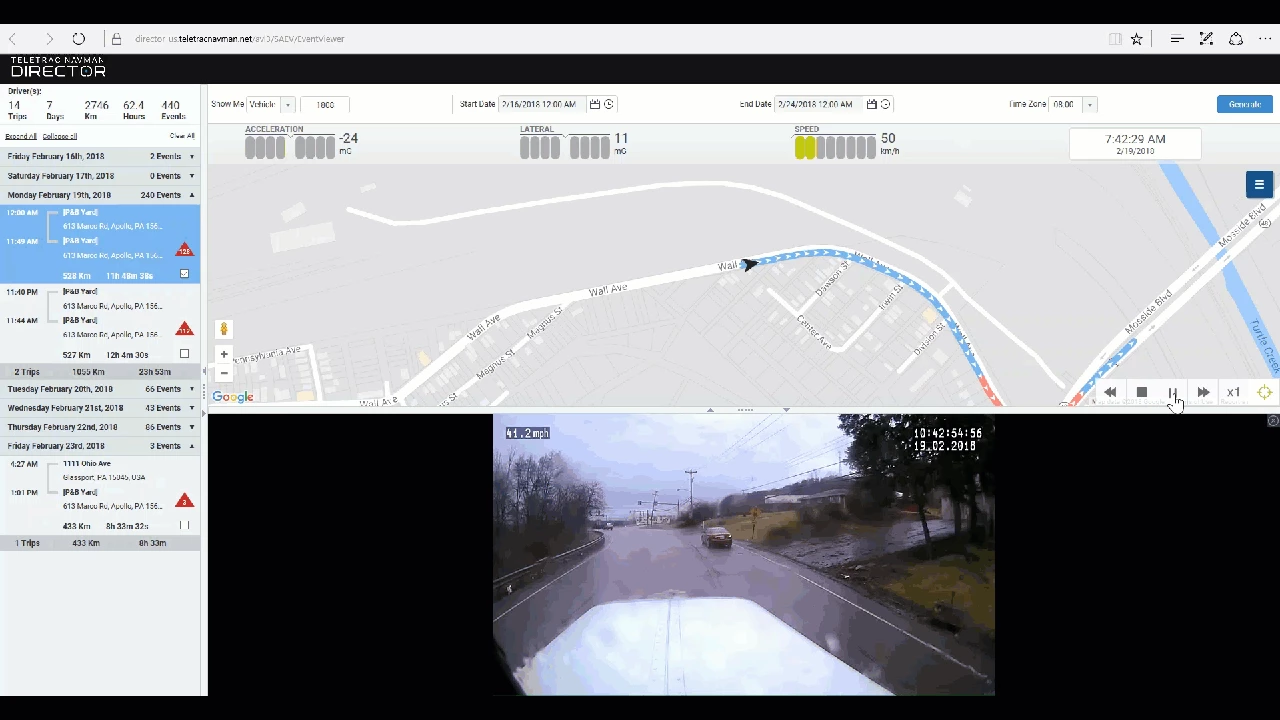

A: Businesses with fleet operations have a duty of care to their employees to ensure their health and safety whilst completing work-related driving activities, and are encouraged to implement risk assessments as part of this process. This involves determining potential risks to employees at work, which employees might be at risk of harm and how, evaluating these risks and determining the appropriate controls, and then recording this risk assessment, with periodic reviews and updates. Driver risk management, including driver training, are particularly crucial to the effective management of risk. Training is central to ensuring that drivers understand the risks they are faced with while working, including both road safety and checking whether their vehicle is safe to drive. Vehicle trackers can play an important role in keeping tabs on individual drivers and their vehicles in real time when they’re out on the road (thus making them able to alert drivers to potential safety risks before they encounter them), while the driver performance data gathered by telematics has also become integral to the development of driver training programmes.

Q: How can telematics inform driver training, and how does this affect insurance premiums?

A: The detailed driver data provided by telematics systems allows for individually-tailored driver training schemes. It offers hard evidence and insight into the performance of individual drivers when they’re on the road, and can highlight particular areas where there is a need for improvement. For example, undesirable driver behaviours such as harsh braking, aggressive acceleration, rough cornering and tailgating are all made apparent by telematics data. As well as alerting transport managers to the need for training in such areas, this data also provides a powerful debriefing tool, allowing managers to point out shortcomings backed up by unambiguous evidence. Insurers will look for evidence that fleets are taking such proactive steps to monitor the performance of their drivers in terms of road safety, with a view to deliberate intervention to improve individuals’ driving standards. Where data demonstrates an improvement in driver conduct and a reduction in accident rates, this is likely to be rewarded by insurers.

Q: What can fleets do to create a culture of robust road safety?

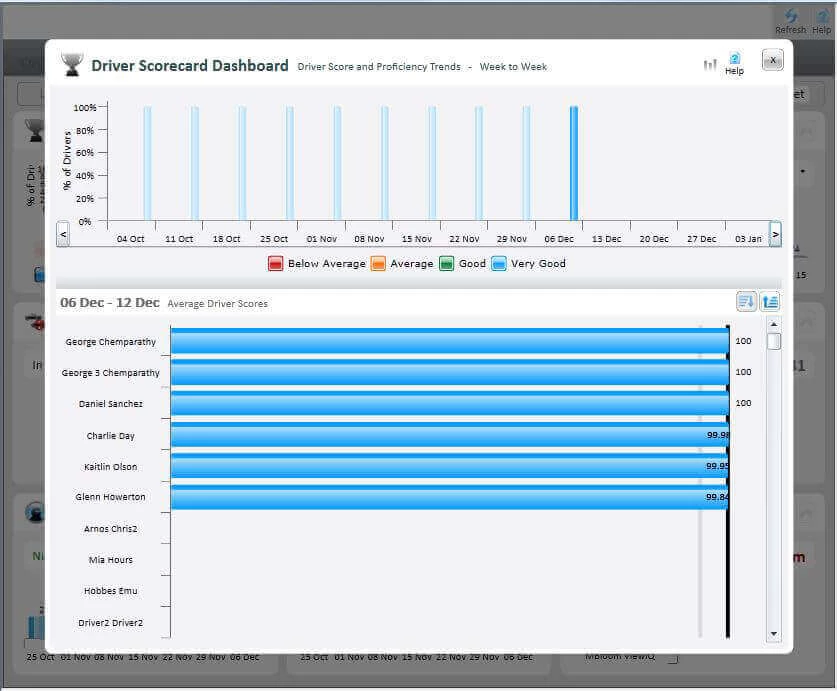

A: Fleets need to continually be proactive about creating a culture of road safety. This involves not just communicating a core set of principles that can help drivers develop greater awareness of the dangers they face while on the road, and how they might better anticipate and prepare for the actions of other road users. It also involves generally accentuating the importance of robust road safety, and continually underlining that commitment. The adoption of positive incentives, such as friendly competition among drivers, can be particularly valuable in this regard. Telematics can again help here. For example, a league table could be established ranking drivers according to safety criteria, with prizes on offer to the safest drivers and the most improved. Schemes such as this can play a very important role in reinforcing safe driving habits.

Q: How can fleets take account of changing accident risks throughout the year?

A: As weather conditions change, so the risks faced by fleets also change. Studies suggest that the winter months are especially risky given the increased likelihood of icy and snowy conditions, but there are weather-related risks all year round. Fleets therefore need to ensure that they take sufficient account of this. Telematics systems allow fleets to do so, by allowing for real-time route planning adjusting for weather-related risks and hazards. Weather telematics uses weather reporting and forecasting data to plan and update routes depending on changing weather conditions, reducing the risk of delays and disruptions as well as enhancing driver safety. This is another factor that insurers may well take into consideration when setting premiums. Drivers must be made aware of changing road conditions, and provided with proper training on how to drive appropriately in different conditions. This can help to reduce accident rates, improve claims histories and cut premiums.

Q: Can telematics help protect fleets against false claims?

A: Another important benefit of telematics is that it can help fleets avoid having to pay out for mendacious accident claims made against them. According to a survey carried out in 2015 by RAC Business, over a third (35%) of UK businesses had used telematics data to contest an accident claim or a speeding fine. Of 500 firms surveyed, 18% said they had proved that a driver was not at fault for a claim through the use of driver telematics data. In addition, 58% of respondents said that telematics had helped them reduce the amount they paid in speeding fines, while just under half (47%) said the technology had helped them cut insurance premiums. The potential implications of this are substantial, and indicate that fleets are using telematics to save them millions of pounds on such inaccurate claims and fines as well as premiums.